Commercial Invoice For Canada

Consular Invoice - Mainly needed for the countries like Kenya Uganda Tanzania Mauritius New Zealand Burma Iraq Ausatralia Fiji Cyprus Nigeria Ghana Zanzibar etc. Net and gross weight.

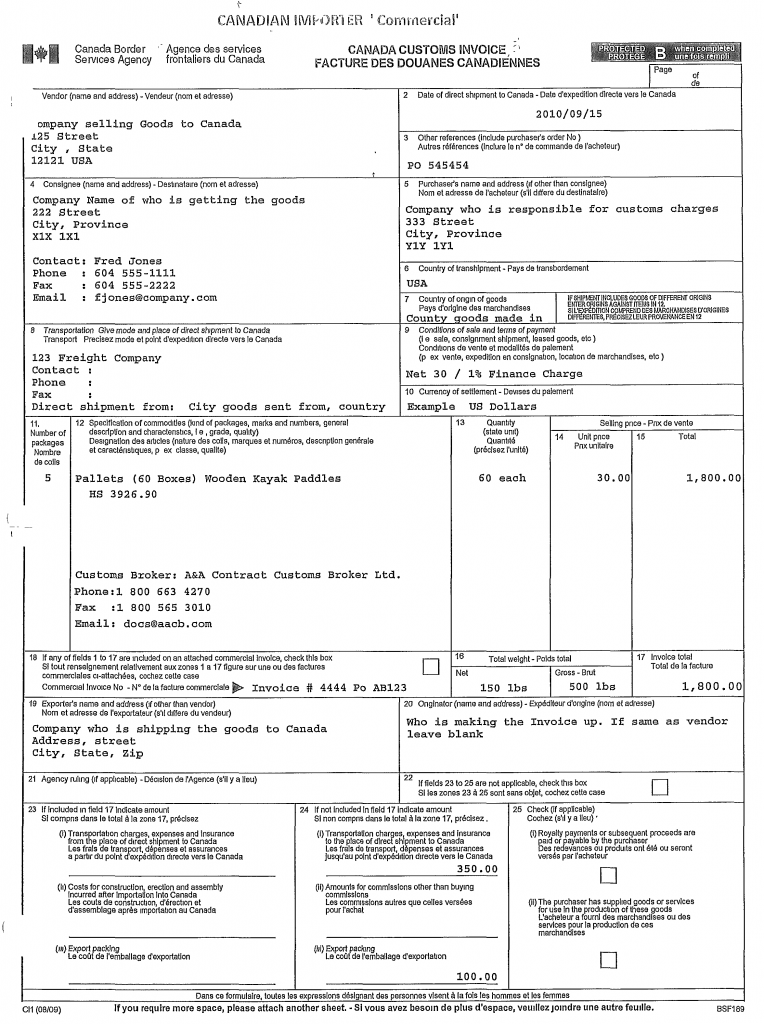

21 Steps To A Completed Canada Customs Invoice A A

The document shows that the taxes and duties have been appropriately assessed before the continuation of the shipment.

. In summary despite the fact that a proforma and commercial invoice may look very similar there are three key. You should ensure with your carrier that the importer of record will be notified of your shipment as soon as it arrives at US. Required documents for international shipping include Commercial Invoice Export Declaration B13A Certificate of Origin and the Toxic Substances Control Act form.

Home All Shipping Services International Shipping Guide to Customs Forms. You should also include a NAFTA Certificate of Origin. A detailed description of the goods in the shipment.

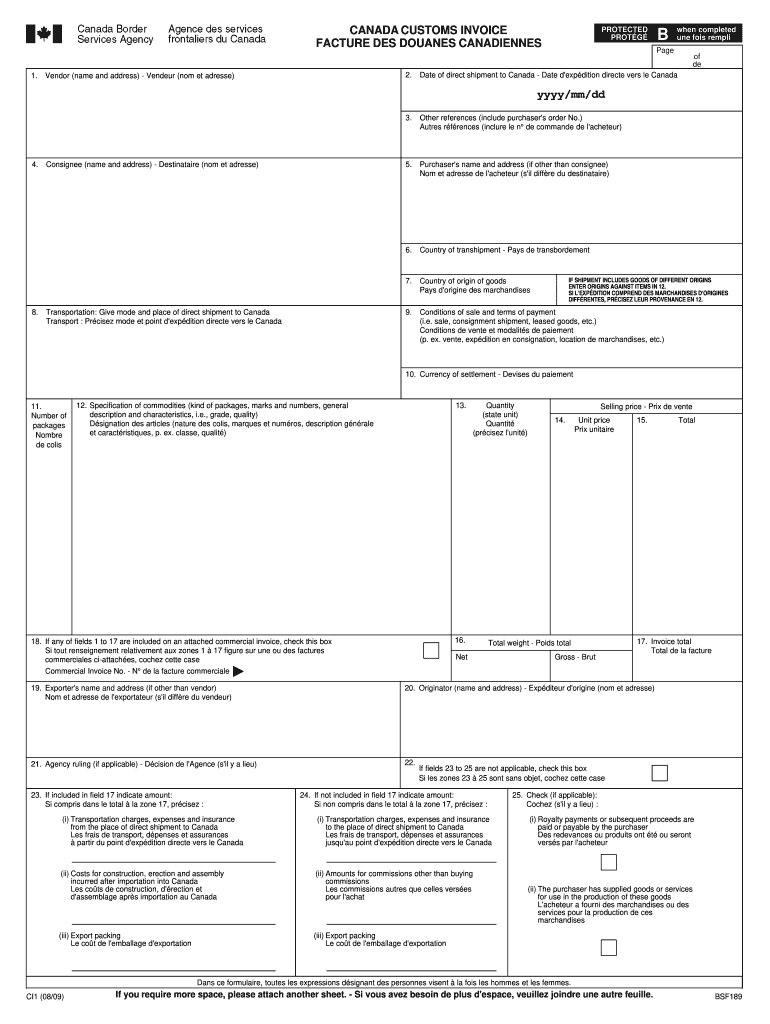

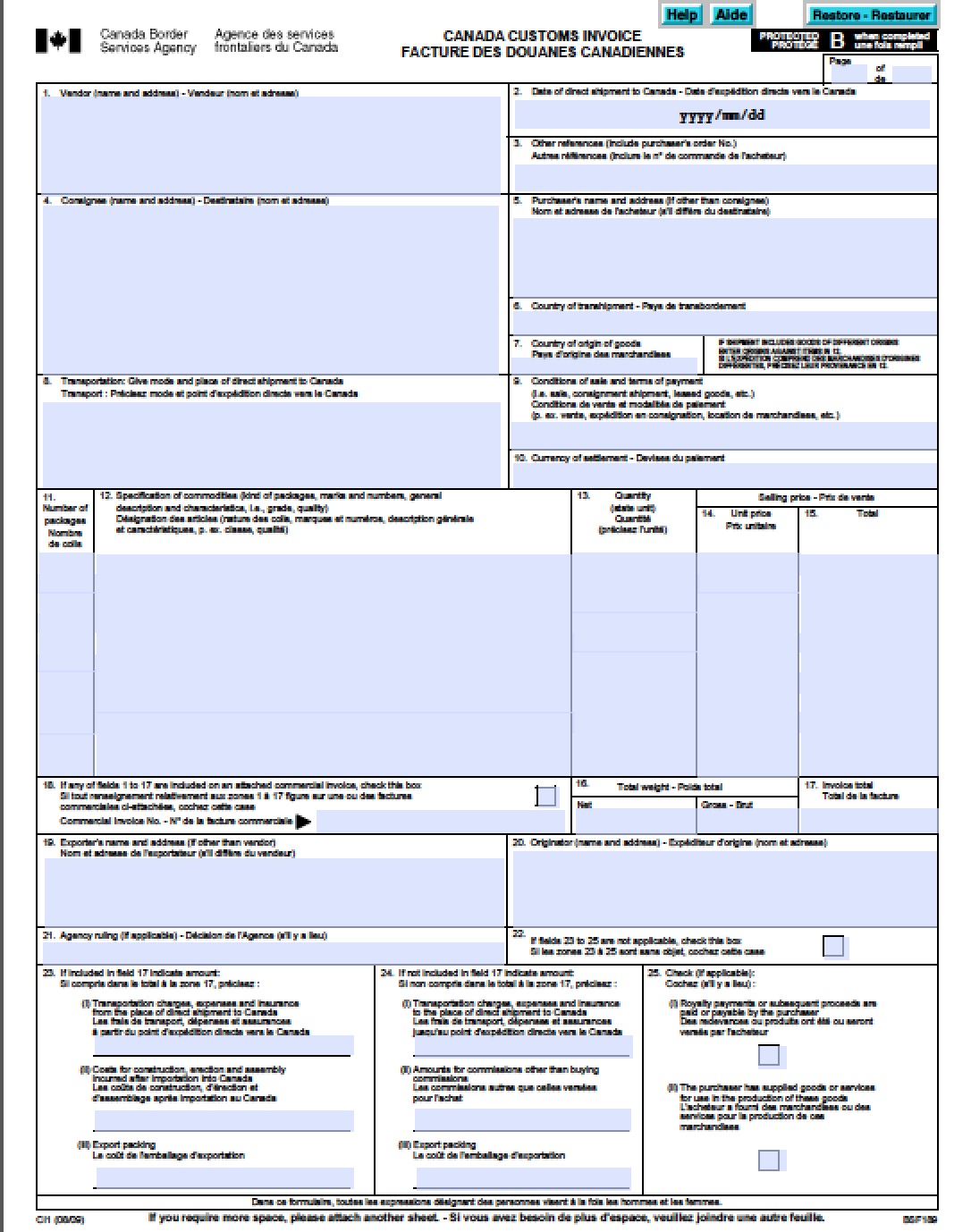

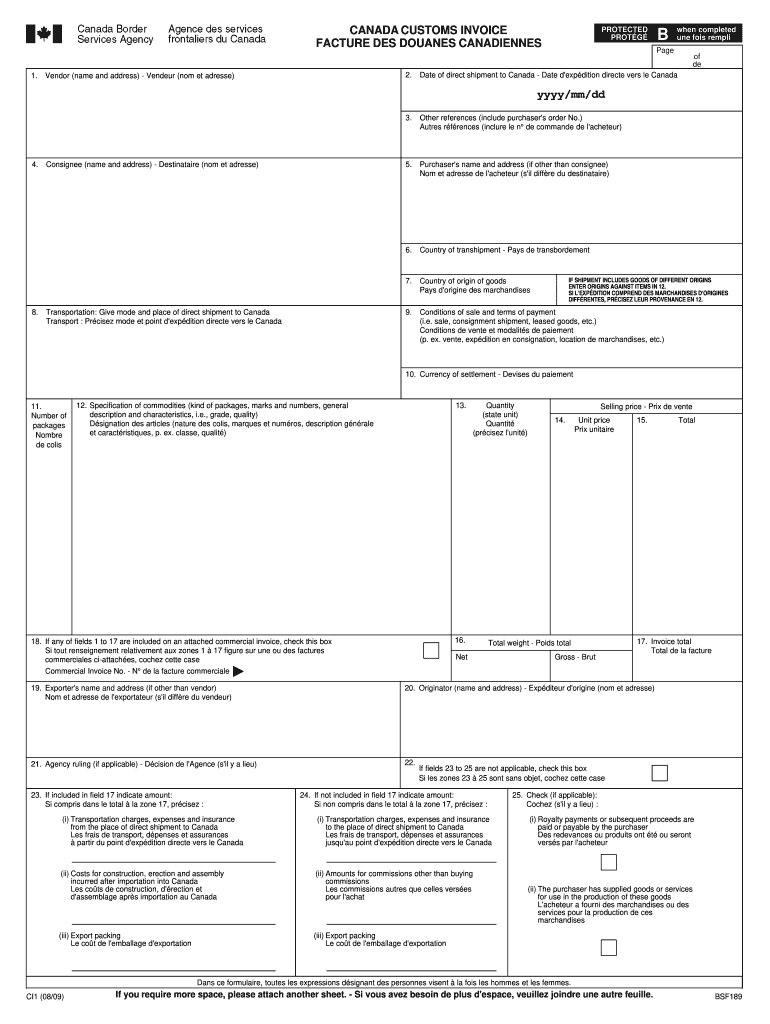

It is prepared in the prescribed format and is signed certified by the counsel of the importing country located in. You can use a Commercial Invoice in place of a CCI as long as you include the following information. Governments that use the commercial invoice to control imports will often specify its.

What Is a Commercial Invoice. These documents are often used by governments to determine the true value of goods when assessing customs duties. The seller prepares a few more documents including a packing list certificate of origin shippers letter of instruction and bills of lading.

This is one of the documents which will be checked by US Customs and Border Protection as part of the import process so getting it right will make sure your goods. The commercial invoice on the other hand serves to detail the financial transaction for the sale of the goods being transported such as payment details instructions and terms. The shipment must have its commercial invoice with it.

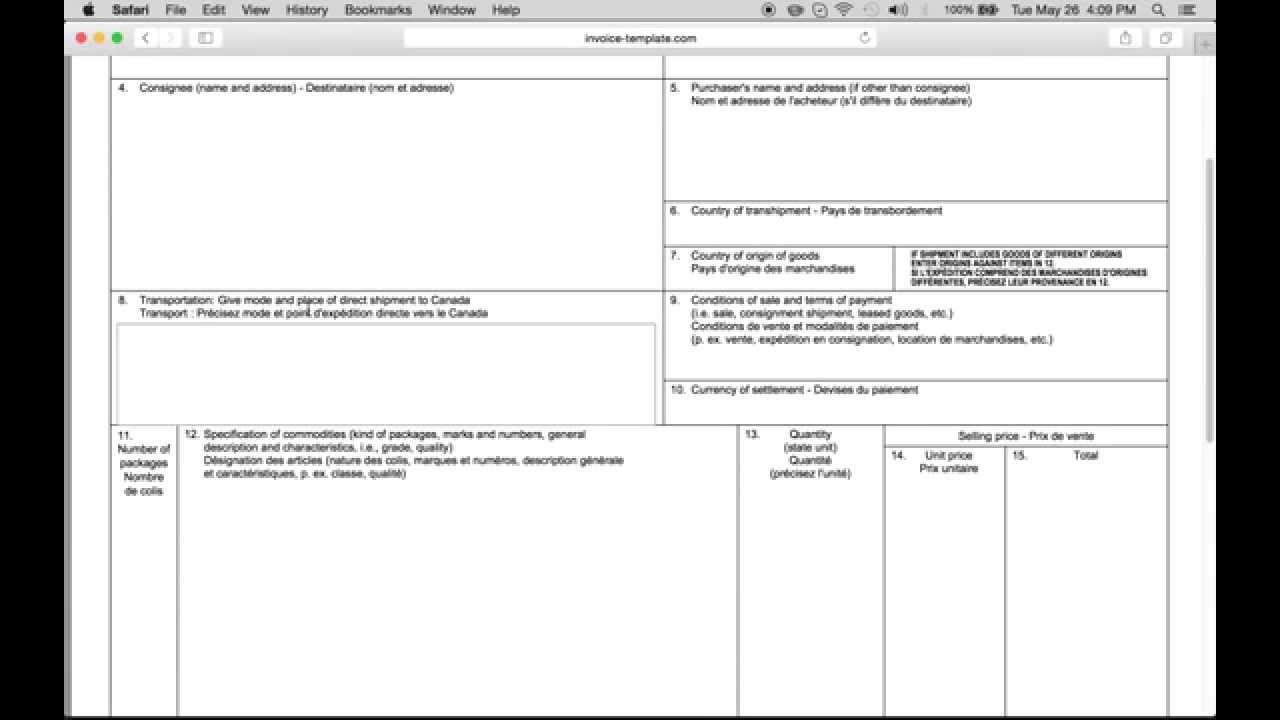

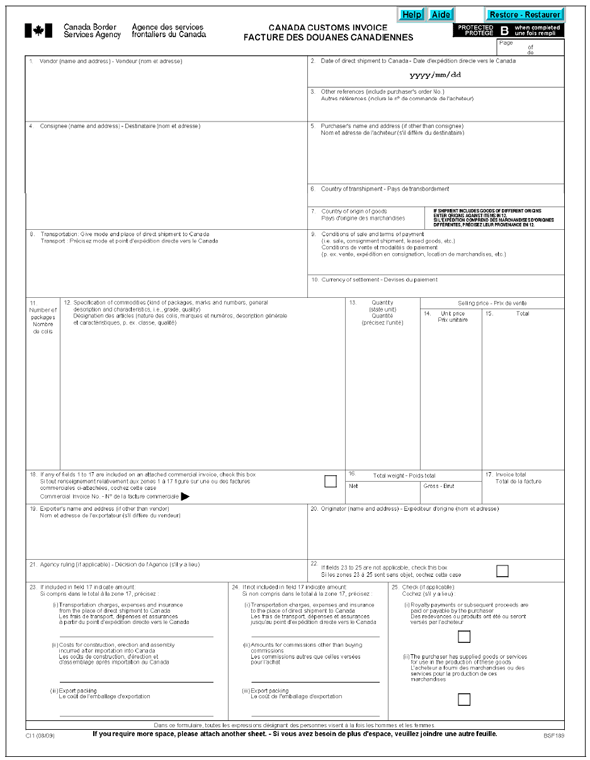

Commercial Invoice - Issued by the exporter for the full realisable amount of goods as per trade term. This form is used to provide the necessary information to customs for all Canada-bound commercial goods. Under the doctrine of informed compliance an importer must correctly classify and value imported merchandise.

A commercial invoice is a bill for the goods from the seller to the buyer. Note that certain localities such as Canada and countries in the Caribbean may require specific invoices instead of or in addition to the standard commercial invoice form Proforma vs. The problems for importers and customs brokers begin however when the commercial invoice from the foreign supplier either is not on a FOB Port basis or does not include all dutiable costs.

Updated May 31 2022. Canada Customs requires certain information to be provided. A commercial invoice is an invoice that you include when youre shipping goods to other countries.

A DHL commercial invoice is a document prepared by an exporter that classifies the contents or merchandise of a shipment in order that customs can properly receive and clear the shipment. Add a unique invoice number to the top portion of the document. Shipping Ship Now Open a FedEx Account Shipping Rates and Delivery Times Schedule and Manage Pickups Order Supplies.

In many cases companies use the Canada Customs Invoice or CCI a special invoice designed by the government when shipping goods abroadThe seller uses the Canada Customs Invoice to bill for goods and the buyer uses this. Customs providing one will smooth your shipments path across the border. The easiest way to number invoices is to do it numerically.

You should decide on a numbering system and stick to it. The commercial invoice is one of the main documents used by customs in determining customs duties. The exporters full name address and country.

After receiving the purchase order the exporter prepares the ordered goods and creates a commercial invoice to conclude the final pricing and related details. A Canada Customs Invoice CCI or Commercial Invoice is required for every commercial entry into Canada. The packing list is sent to the receiver of the goods or consignee while the commercial invoice is sent to the party responsible for the payment of the goods.

The importers full name and address. Invoice numbers are used for reference purposes both when youre discussing an invoice with a client and when youre filing them for your business records. Unit price of each item using the currency of settlement.

In other words all importers are required by law to. The form may be prepared by the supplier importer. As well the document.

While this is not legally required by US. If youre selling goods in the US whether on a regular basis through your own established business or even just a one off eBay sale youll probably need to create a commercial invoice.

Free Canada Customs Commercial Invoice Template Form Ci1 Pdf Word Excel

2009 2022 Form Canada Ci1 Fill Online Printable Fillable Blank Pdffiller

Shipping 203 The Commercial Invoice Your Shipment Passport Secureship Ca

Canada Commercial Invoice Format Free Invoice Template For Mac Online Mac Is A System Made By Apple Invoice Template Invoice Format Invoice Format In Excel

31 Printable Canada Customs Invoice Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Commercial Invoice Ci In Foreign Trade

Comments

Post a Comment